Construction, once a locally grounded industry, now stands exposed to the winds of global change. Wars erupting thousands of miles away, trade tensions between superpowers, mass migrations, and fractured alliances — these are no longer headlines we scroll past. These are the background conditions that shape the cost of concrete, the availability of skilled labour, and the appetite of financiers.

We are entering an era where the boundaries between geopolitics and business are blurring.

And construction — asset-heavy, labour-dependent, and slow to pivot — is uniquely vulnerable.

The Global Chessboard is Shifting

From the Russia-Ukraine war to the ongoing Israel-Gaza conflict, from Taiwan’s rising tension with China to the political polarization seen across democratic nations, we are witnessing a period of intensified global instability. This isn’t just about conflict zones — it’s about how nations are redrawing lines of trust, trade, and cooperation.

Canada may feel distant from these geopolitical hotspots, but in a connected economy, distance offers no immunity. Supply chains depend on predictability, capital flows depend on stability, and labour markets depend on policy coherence. Today, all three are under pressure.

Construction is No Longer Local

Consider this:

- The aluminum used in siding systems may rely on smelters in geopolitically sensitive zones.

- That truck driver shortage? It may trace back to a wider economic realignment in the wake of pandemic-era disruptions.

- Financing delays for multi-family housing? Possibly connected to foreign capital retreating due to global risk aversion.

When instability becomes systemic, everything local is shaped by everything global.

The Strategic Wake-up Call

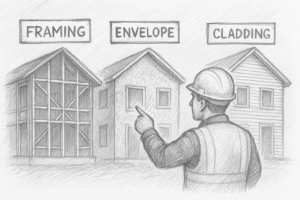

This is not a call for fear. It’s a call for strategy. For the construction industry, especially those in building envelopes, cladding, and development-heavy trades, now is the time to recognize that geopolitics is no longer just dinner-table conversation — it’s a core business factor.

Successful companies will not only track material prices and labour forecasts but also ask:

“What’s happening in the world that might reshape the playing field I’m building on?”

Up Next in Part 2: The Economic Chill

We’ll examine how inflation, interest rates, and investor caution are redrawing the map of what gets built — and what doesn’t.