High interest rates are squeezing construction financing, but relief might be on the horizon. As of September 2025, the Bank of Canada’s policy rate holds steady at 2.75%, following gradual cuts earlier in the year (wowa.ca, bankofcanada.ca). Recent weak jobs data has boosted odds of a 25-basis-point cut in September or October, potentially easing to the low end of the neutral range and supporting modest economic growth of around 1.8% for the year.

In construction in uncertain times, this squeeze means delayed projects and tighter budgets, especially for residential and commercial builds where borrowing costs bite hard. Developers are extending timelines by 6–12 months, waiting for lower rates to revive housing starts and investment.

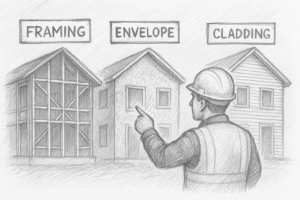

At Lynx Siding Inc., we’re helping clients navigate this by focusing on high-performance cladding upgrades that qualify for green incentives, offering faster ROI even in a high-rate environment. Construction in uncertain times calls for smart pivots — like retrofits that enhance energy efficiency and appeal to cautious lenders.

Quick Tip: Run scenario plans assuming rates stay elevated for another quarter—budget for higher carrying costs and prioritize modular envelope solutions to cut timelines.

How are interest rates impacting your financing? Drop a comment or connect on LinkedIn. Stay tuned for Episode 3: Adaptive Strategies.