In our previous installment, “The World at a Crossroads,” we explored how global instability — from wars to trade tensions — is reshaping the construction landscape. Now, we turn our focus inward to the economic forces at play. The economic chill sweeping through Canada and beyond is more than a temporary dip; it’s a profound shift driven by persistent inflation, fluctuating interest rates, and cautious lending practices. For Lynx Siding Inc., experts in high-performance exterior cladding and building envelopes, construction in uncertain times means equipping our partners — general contractors, developers, and architects — with the insights to navigate these challenges. By understanding these dynamics, we can turn potential setbacks into opportunities for resilient, efficient projects.

Inflation’s Grip: Rising Costs and Material Pressures

Inflation remains a stubborn adversary for the construction industry. As of July 2025, Canada’s annual inflation rate has eased to 1.7%, down from earlier peaks, yet core measures like CPI-trim hover around 3% — still at the upper end of the Bank of Canada’s target range (reuters.com, rbc.com). This moderation is welcome, but it follows years of elevated costs that have inflated everything from raw materials to labour wages. Residential construction costs, for instance, rose by 0.8% in the fourth quarter of 2024, with experts forecasting a slight uptick of 3%-5% in total project costs for 2025 due to lingering supply chain echoes from global disruptions (smart-capital.ca, kelownarealestate.com).

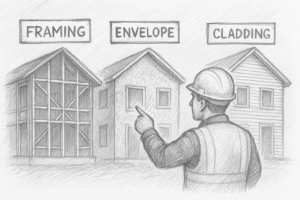

In construction in uncertain times, these inflationary pressures hit building envelopes hardest. Materials like aluminum and insulation — key to our high-performance cladding solutions at Lynx Siding — face volatility from global tariffs and trade wars. The U.S. imposition of higher tariffs in early 2025 has already driven up input costs for imported goods, potentially adding layers of expense to Canadian projects reliant on cross-border supply chains (construction.com). Developers and contractors are responding by rethinking budgets: prioritizing modular cladding systems that reduce on-site labour and waste, or opting for locally sourced materials to hedge against international price swings. At Lynx Siding, we’ve seen success with clients who integrate our durable, energy-efficient siding early in planning, locking in costs and enhancing long-term value amid rising expenses.

Interest Rates: The Financing Squeeze

The Bank of Canada’s policy rate stands at 2.75% as of July 2025, marking a hold after gradual cuts from 3.75% earlier in the year (tradingeconomics.com, kelownarealestate.com). While these reductions aim to stimulate growth, their impact on construction has been slow, with economic forecasts projecting only moderate expansion of 1.8% in 2025 as excess supply is absorbed. High interest rates earlier in the cycle have deterred investment, particularly in residential and commercial builds, where borrowing costs can make or break feasibility.

Construction in uncertain times amplifies this effect. Developers are extending project timelines to wait for further rate drops, expected to dip into the mid-2% range by year-end, which could lower mortgage rates and boost housing starts (mastt.com, cmhc-schl.gc.ca). For high-performance building projects, this means a strategic pivot: focusing on retrofits and upgrades that offer quicker ROI, such as installing advanced cladding to improve energy efficiency and comply with evolving green building codes. Lynx Siding advises our partners to model scenarios where rates remain elevated — perhaps for another 12-18 months — ensuring budgets account for higher carrying costs while emphasizing value-added features that attract eco-conscious investors.

Bank Hesitancy: Tight Credit and Risk Aversion

Adding to the chill is banks’ growing caution in financing construction. Major Canadian lenders have ramped up provisions for credit losses by 20-50% in recent quarters, reflecting fears of defaults amid economic uncertainty and trade risks (linkedin.com). This hesitancy stems from broader instability, including potential U.S. trade wars that could disrupt cash flows for cross-border projects (theglobeandmail.com). As a result, pre-sales for new developments are uneven, and infrastructure financing faces hurdles, with calls for innovative solutions like asset recycling to bridge gaps (scotiabank.com).

In construction in uncertain times, this translates to contractors needing stronger balance sheets and credible partnerships to secure loans. Banks are favouring projects with proven resilience, such as those incorporating sustainable materials that reduce long-term operational risks. At Lynx Siding, we position ourselves as that reliable partner — our expert tips include conducting thorough risk assessments on cladding durability to demonstrate project viability to lenders. For instance, by choosing our weather-resistant siding systems, clients can mitigate maintenance costs, making their proposals more attractive in a tight credit environment.

Rethinking Timelines and Budgets: Adaptive Strategies

Faced with these economic headwinds, developers and contractors are overhauling their approaches. Project timelines are stretching — sometimes by 6-12 months — to align with anticipated rate relief and stabilize budgets (jll.com). Budgets are being recalibrated with buffers for 4–5% cost inflation, emphasizing phased construction and flexible contracts (publications.turnerandtownsend.com). Global forecasts predict a 2.4% dip in construction activity this year before a rebound in 2026, underscoring the need for patience and foresight (oxfordeconomics.com).

Construction in uncertain times demands innovation. Lynx Siding recommends scenario planning: What if tariffs spike material costs by 10%? Diversify suppliers and invest in modular designs. Or, if financing delays persist, prioritize envelope upgrades that qualify for green incentives, accelerating approvals and funding. Our team has helped clients save 15-20% on long-term expenses through such strategies, building trust and fostering mutually beneficial relationships.

Looking Ahead: Building Resilience Amid the Chill

The economic chill is testing the construction industry’s mettle, but it’s also an invitation to evolve. By staying informed on inflation trends, interest rate trajectories, and lending shifts, we can craft projects that endure. At Lynx Siding Inc., we’re committed to being your expert ally in high-performance building — delivering cladding solutions that enhance efficiency and value, no matter the economic weather.

Join the conversation:

- How is the economic chill affecting your projects?

Share your thoughts in the comments below, or connect with us on LinkedIn for personalized insights. Stay tuned for Part 3: Labour in the Crossfire, where we’ll dive into immigration pressures and workforce strategies.